After spending more than a decade as a courthouse planning consultant, I began studying for the American Institute of Certified Planners (AICP) certification exam last year. I must admit that the thought of one topic, in particular, struck fear in my heart and had me running—not walking—for the coffee pot: History, Theory, and Law. Sounds frightening.

No one was more surprised than I to find that I enjoyed learning about the history and theories of the planning profession. It broadened my knowledge about critical historical events that have helped shape the planning profession of today. The 2016 presidential campaign was underway while I was studying for the exam. I naturally started to draw parallels between critical events in our nation’s history and opportunities that could present themselves under a Trump administration.

Bridging the Past and Present

President Trump made campaign pledges and has made statements early in his administration that support significant investments in the country’s aging infrastructure. He has also touted the use of public-private partnerships (P3s) to help fund infrastructure development projects. The backdrop to this is the government’s difficulty obtaining funding at all local, state, and federal levels. The result is public buildings and other infrastructure that do not adequately meet the needs of modern society.

The New Deal era was a period in history when large investments in infrastructure development played a vital role in putting unemployed workers back to work and revitalizing the economy. In recent years, the American Recovery and Reinvestment Act of 2009 (ARRA) was enacted under President Obama to inject life into the economy during a recession. Today, opportunities for infrastructure investments could present themselves under an administration guided by a president with an extensive background in real estate development.

As a court consultant, I am particularly interested in investment opportunities and courthouse funding for the country’s aging infrastructure. Do you think the emphasis on P3s under this administration could open avenues for courts that desperately need more and improved space?

I stay out of politics. This blog is in no way an endorsement of any politician. Instead, it's an attempt to take an objective - and perhaps a bit hopeful - look at this topic.

The Opportunity

President Trump’s infrastructure proposal, which he has coined the “American Energy and Infrastructure Act,” would provide tax incentives for private investors who invest in needed infrastructure projects with the goal of stimulating the economy.

You may have heard one of Trump’s campaign pledges to provide $1 trillion in infrastructure improvements nationwide and significant tax incentives for private investors in P3s. A speaker at a recent American Planning Association workshop in DC called this potential for infrastructure investment and the use of P3s a “political sweet spot.” Under P3 agreements, private entities could assume much of the risk associated with designing, constructing, operating, and maintaining planned infrastructure, which typically falls within public agencies' purview.

Concurrent with Trump’s infrastructure proposal, the House and Senate are considering bills enabling state and local governments to issue up to $5 billion of private activity bonds (PABs) to finance the renovation or construction of qualified public buildings, which would be government-owned under P3 arrangements. The current administration is pushing infrastructure improvements in a climate that is supposed to be favorable to the private sector. As such, P3s could become more viable for the state and local sectors to implement.

Although P3s have begun building momentum in financing state transportation projects, they have been responsible for a tiny percentage of overall infrastructure projects undertaken in recent decades. Interestingly, P3 is widely used in Europe, Canada, and Australia for all projects, including courthouses and courthouse funding.

Trump’s proposal could represent a seismic shift in infrastructure funding. As the Trump administration continues to develop its proposal, a fair amount of buzz is growing among legislatures, private investors, and infrastructure associations across the country.

A Peek Back in Time

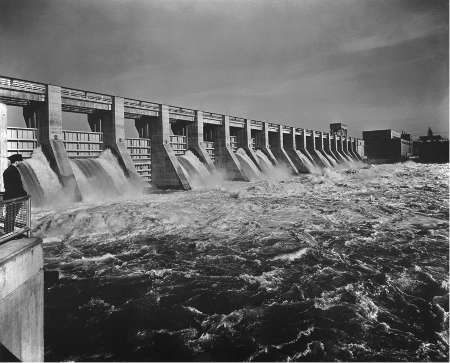

In response to the Great Depression, FDR enacted reforms that focused on “3 Rs” – relief, recovery, and reform. Critical parts of this reform included the Public Works Administration (PWA), which promoted economic development by investing over $6 billion in infrastructure built by private construction companies. The PWA helped stabilize the Depression-era economy by funding over 34,000 large-scale construction projects, including roadways, bridges, schools, hospitals, dams, airports, and public housing. It was in effect from 1933 until 1943, when FDR directed the nation’s efforts toward industry supporting WWII. Much of the infrastructure planned and built as part of PWA, including the Lincoln Tunnel, Grand Coulee Dam, and Los Angeles Airport, is still used today.

Where Are We Today?

While it’s great that some of the Depression-era physical infrastructure still serves our country today, the unfortunate news is that the general state of much of its infrastructure can be summarized in two words: old and broken. Indeed, you’ve heard stories about government buildings deemed health threats to their occupants. Or it was collapsing bridges and potholes that could swallow an 18-wheeler. The American Society of Civil Engineers gives our nation’s infrastructure a grade of D+ and says that $3.6 trillion in spending is needed by 2020 to bring it up to standard.

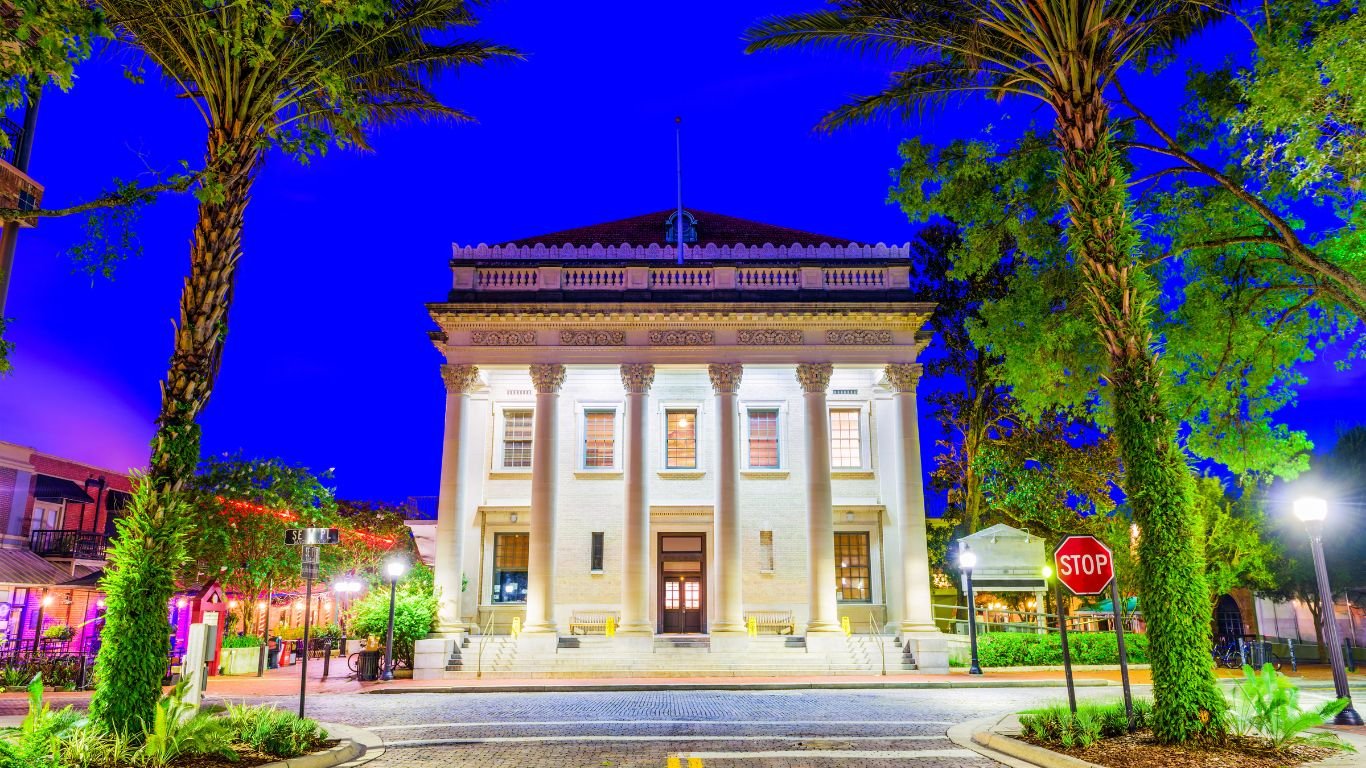

Stroll through one of our country’s older courthouses, and you may be surprised at the level of deterioration. Rat infestations, lead in the drinking water, flooding basements, harmful levels of mold – I’ve seen it all as I’ve traveled across the country as a court planning consultant. Investing in existing and new courthouses is vital to meet the operational and security demands of the 21st century. Courthouses are our judicial system's cornerstone and serve an important civic function. Courthouses house thousands of judges and government workers, host various users, and symbolize our country’s judicial system.

Here are a couple of recent P3 experiments involving courthouse construction and courthouse funding:

- Under the administration of former California Governor Arnold Schwarzenegger, the state used a P3 arrangement to build the Governor George Deukmejian Courthouse in Long Beach, which cost $490 million. The state will repay the costs over 35 years. The courthouse was the first in the state to be built using a P3 and is spurring additional use of P3s to fund needed infrastructure, including a new civic center in Long Beach. The courthouse opened in 2013 and won two Design-Build Institute of America awards in 2014.

- In Howard County, Maryland (close to home for me), the government is studying the possibility of using a P3 arrangement for courthouse funding. Under the proposal, private industry would share the cost of a courthouse replacement project for the almost 200-year-old courthouse. Using a P3 could lower the short-term cost to the county by reducing the amount the county would have to borrow in bonds.

Other governments are also testing the waters using P3s for infrastructure projects beyond transportation. For instance, the Office of Public-Private Partnerships has been created to promote P3s in infrastructure projects across the District of Columbia. The Office plans to oversee the construction of a new jail, the renovation of the police headquarters, and an upgrade to the streetlight system. Dallas’ Klyde Warren Park provides five acres of green space over a freeway by using a P3.

Where Could We Go in the Future with Courthouse Funding?

According to a recent National Conference of State Legislatures report, a key benefit of P3s is leveraging the private sector’s expertise and resources. Court managers have long understood that traditional funding via taxes and bonds is often insufficient. While courts wait years for funding, courthouses are deteriorating, and the public image and operations are suffering.

Suppose the infrastructure proposal and the use of P3s take off under the Trump administration. In that case, there is great potential for widespread improvement of our nation’s vast inventory of courthouses and other aging infrastructure. Expanding P3s to fund courthouse construction, renovation projects, and other infrastructure improvements would place a portion of the financing burden on the private sector. This would free up public funds to pay for more projects than would otherwise be possible. Plus, we’d be tapping into the tremendous knowledge base the private sector offers.

Many courthouses at all levels of government have been waiting years for courthouse funding, and the P3 process could assist them in getting projects moving forward sooner. Also, the government would not have to assume all the risks, as the P3 process usually has to adhere to a maintenance schedule, keeping the buildings in better repair.

If the government embraces the use of P3 arrangements, courthouse funding projects that have languished could gain momentum, and benefits could be achieved throughout the building's lifecycle. Using P3 arrangements could provide some viable opportunities for court managers under the current administration. I may be going out on a limb, but opportunity awaits!