As we are all painfully aware, the COVID-19 pandemic is wreaking havoc on the U.S. economy. We’ve seen soaring unemployment rates, a plummeting GDP, and the most significant U.S. economic downturn since the Great Depression. If you are a court manager, you’re likely pondering the impact this contracting economy will have on caseload and other aspects of workload in your court in the coming months and years.

On the surface, it may seem intuitive that crime rates would increase when many people face economic hardship, resulting in a growing criminal caseload. But is that necessarily the case? You may also theorize how the slumping economy will impact your court’s civil caseload. Will more credit and domestic disputes occur? These are tough questions, and unfortunately, there are few clear-cut answers.

As often said, the past is the best predictor of the future. So let’s look back in time at some of the patterns that have emerged during prior recessions. We’ll also look at some theories about the relationship between the economy and crime that have been called into question or debunked. Perhaps this article can help shed some light on what your court may expect as the U.S. economy struggles to recover.

Crime and the Economy

The strain theory of crime, popular in criminology during the mid-20th century, asserts that financial strains or stressors are associated with increases in criminal behavior. However, this theory began coming into question in the 1970s and 1980s as a growing body of research revealed the difficulty in establishing economic reasons for changes in our nation’s crime rate. We can glean from history that the state of the U.S. economy is not always a reliable predictor of crime rates. The following examples illustrate this point:

- Violent crime rates soared in the early years of the Great Depression, but that trend did not continue throughout the 1930s. Although the nation struggled to recover from the depression and was confronted with another severe economic downturn from 1937-1938, crime rates decreased by approximately one-third between 1934 and 1938. Unexpected? Let’s fast forward a few decades.

- In the 1960s, the U.S. economy experienced unprecedented economic growth marked by a flourishing stock market, tax cuts, high-tech electronics development, GDP increase, low unemployment, and wage growth. Interestingly, as the economy surged, so did crime rates. Both property and violent crimes more than doubled during that decade.

- During the mid-to late-1980s, the economy had rebounded from the deep recession of the early 1980s and experienced a sustained period of growth through the early 1990s. According to FBI crime reports and the Bureau of Justice Statistics (BJS) annual victimization survey, the national violent crime rate experienced astounding growth in the 1980s and soared to historic highs in the early 1990s. Property crime rates also remained close to historical highs during that time.

The examples above highlight the problem of trying to draw parallels between the economy and crime. This can make it tricky to predict how the current recession could impact the criminal caseload in our nation’s courts. Let’s take a deeper dive.

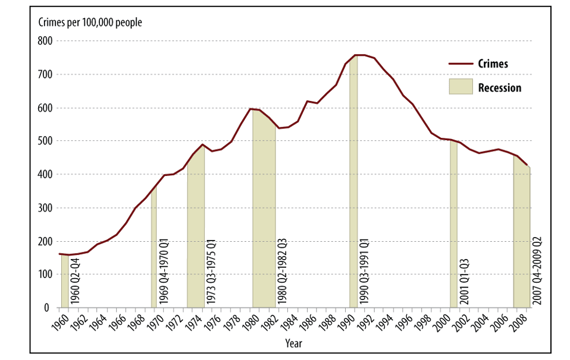

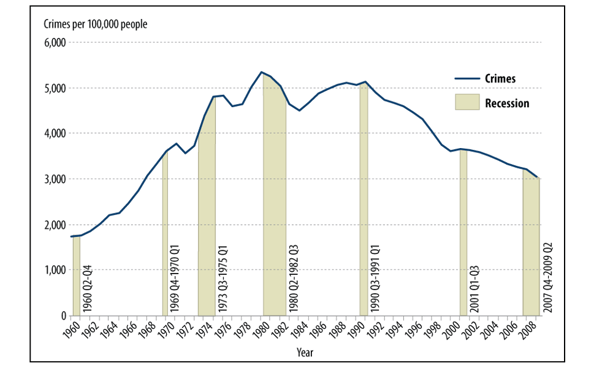

Figure 1 and Figure 2 display the relationship between all U.S. recessions since 1960 and the violent and property crime rates, respectively. Figures 1 and 2 show that the relationship between recessions and crime rates has been inconsistent. Although crime was on the rise during the recessions of the 1970s, crime remained stable or even declined during most of our nation’s other recessions. Notably, between 1960 and 1990, the crime rate climbed upward, irrespective of whether the U.S. was in a recession.

Figure 1. Relationship between recessions and violent crime rate, 1960-2008. Graph from Kristin M. Finklea, Economic Downturns and Crime. Congressional Research Service, 19 Dec. 2011, pg. 3

Figure 2. Relationship between recessions and property crime rate, 1960-2008. Graph from Kristin M. Finklea, Economic Downturns and Crime. Congressional Research Service, 19 Dec. 2011, pg. 4

From a historical perspective, the notion that crime will rise during periods of economic hardship doesn’t seem to play out consistently. Many criminologists believe that a wide range of other factors are more likely to lead to changes in crime rates, including:

- Demographic changes – more males in their criminogenic years can drive crime up; an aging population can bring crime down

- Changes in policing – changes in the number of police officers and law enforcement initiatives can influence reported crimes/arrests

- Prison capacity – when capacity is high, more individuals prone to criminal behavior are likely to be incarcerated, limiting their opportunity to commit a crime

- Family conditions – instability in the family unit is often associated with a higher incidence of crime

- Peer group – a peer group can strongly influence an individual’s propensity to commit a crime

- Biological factors – an individual’s biology can predispose them to commit criminal behavior

- Substance abuse – the majority of suspects arrested for most crimes test positive for illegal substances at the time of arrest

Historical trends don’t provide definitive answers, and crime rates are associated with so many other variables – just a handful of which are mentioned above. Therefore, we may be on a fool’s errand trying to accurately predict how the COVID recession will influence criminal caseload without examining other relevant variables. Preliminary reports of the federal criminal caseload showed a drastic decline in criminal filings for the second quarter of 2020 when the pandemic and the related recession first took hold. However, once we have recovered from the current economic crisis, extending the graphs above and plotting the crime trends will be interesting to see where we wind up. Stay tuned for a future blog once we pull out of the recession.

Civil Cases and the Economy

It’s difficult to establish a predictable relationship between the economy and crime. But you may also be concerned about how the recession could impact the civil caseload in your court. There appears to be no mechanism that tracks historical civil filings by case type nationwide. However, the 2008 U.S. financial collapse, from which our country has emerged in the last decade, provides some insight into the relationship between the economy and civil caseload. The following types of civil cases surged in many courts across the U.S. as a result of the Great Recession:

- Mortgage foreclosures

- Debt collection

- Landlord/tenant disputes

- Small claims

- Requests for changes in alimony/child support

- Employment disputes

- Contract disputes

In many regions, the Great Recession had a crippling impact on the ability of courts to process cases. During the recession and in the years following, consumer and business bankruptcy cases and mortgage foreclosure cases skyrocketed. Between 2007 and 2010, there were approximately 3.8 million foreclosures nationwide. In 2008 alone, one in every 54 households foreclosed on their home. Furthermore, many courts nationwide handled a surge in divorce cases as the economy struggled to recover from the recession.

San Francisco's courts were hit particularly hard by the rise in civil caseload from the Great Recession. For example, between 2007 and 2009, employment claims increased by 89%, eviction, and other unlawful detainer cases increased by 49%, collections cases were up by 32%, and breach of contract cases increased by 25%. Stephen Dillard, head of Fulbright and Jaworski’s global litigation practice, stated:

“Generally, litigation rises in an economic downturn as regulators tend to step up enforcement, laid-off workers head to court, and companies need to file more suits in order to collect on money owed.”

A New Mexico Supreme Court judge recently stated that her court experienced a significant rise in civil cases from the Great Recession. She expects a spike in money and domestic violence cases due to the current recession. (Restraining orders in domestic violence cases are handled in civil court.) Courts should prepare for potential growth in civil cases until our nation fully emerges from this recession.

What’s on the Horizon?

As the winter months approach and the number of U.S. COVID cases is creeping back up, there is deepening concern about our nation’s ability to reignite the economy in the short term. It’s difficult to assess how crime rates will respond to the recession, and we may see regional differences depending on whether areas quarantine or remain open for business. However, personal and business bankruptcies and certain categories of civil cases could likely pour into court systems nationwide.

Since many court dockets nationwide have been delayed because of court closures and safety measures in response to the pandemic, courts are burdened by a backlog of cases. Furthermore, most courts across the nation have conducted some proceedings virtually, and many courts have also extended trial deadlines, the constitutionality of which will likely result in numerous appeals. Many courts will be burdened by the backlog of cases and growth in appeals as the nation recovers from the current health crisis and recession.

During economic contraction, deep budget cuts have historically impacted local, state, and federal courts. Thus, courts could be required to handle a growing caseload amid reduced funding, resources, and staff. To further compound the challenges courts face, litigants often choose to represent themselves pro se during tough financial times, as the cost of hiring an attorney is often prohibitive. Many courts are required to assist pro se litigants, such as answering questions about filing pleadings and complying with the formalities of legal procedures. Assisting pro se litigants is typically time- and resource-intensive for courts.

Courts could be facing challenging times ahead. It will be important to hark back to best practices established in your court during the Great Recession that allowed you to handle more cases with fewer resources to weather this current storm.

.png)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

-1.jpg)

.jpg)